Economic News

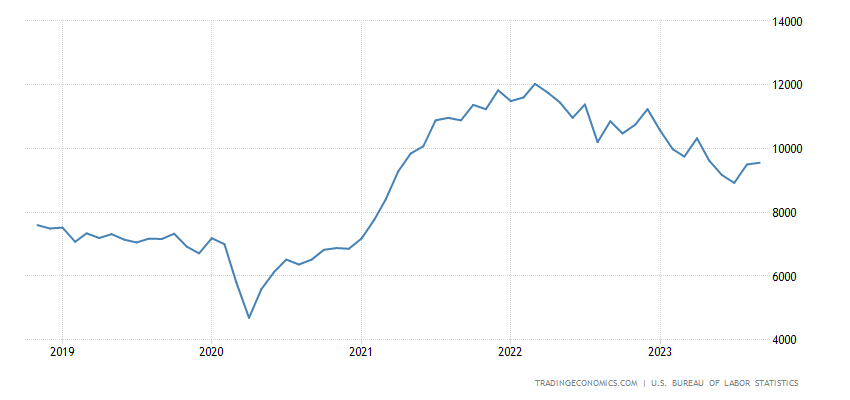

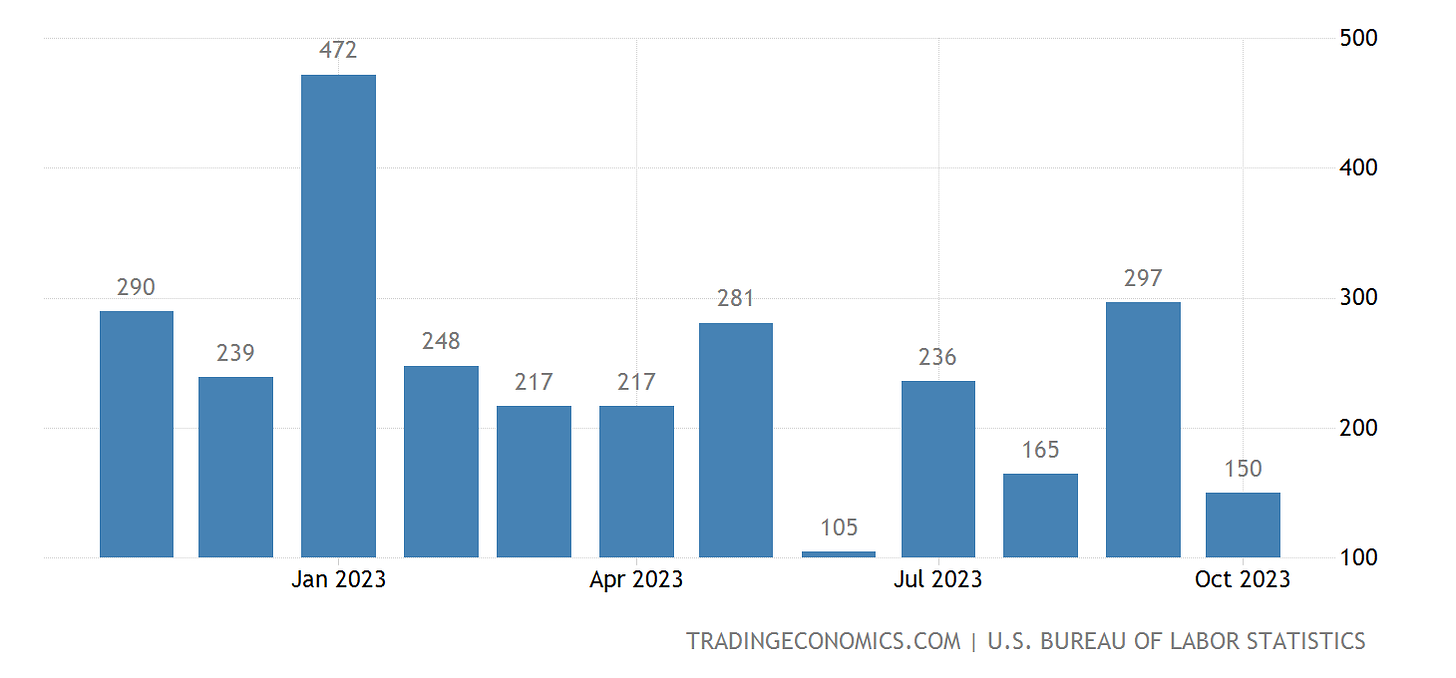

The number of job openings increased by 56000 from the previous month in September 2023. During the month, job openings saw growth in accommodation and food services and in arts, entertainment, and recreation. Job openings declined in other services, the federal government, and information.

This number shows that US companies

continue looking for workers at a relatively high pace, although job

openings have been steadily decreasing since 2022, after the post

COVID-19 reopening. Furthermore, the labor market participation has been

slightly increasing in the last months, which contributes to a

normalization of the labor market.

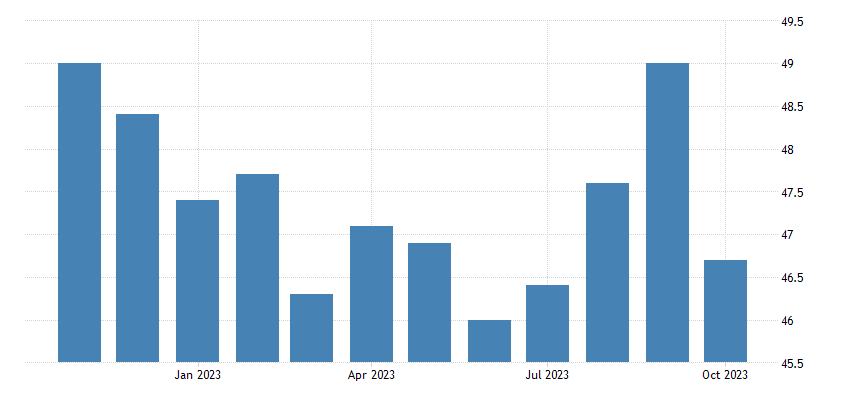

The ISM Manufacturing PMI slipped to 46.7 in October of 2023, from the 10-month high of 49 in the previous month. This number points to the eleventh consecutive contraction in the US manufacturing sector. The data underscored the impact of higher borrowing costs from the Federal Reserve in the sector, further challenging the resilience of US goods producers from other reports. The contraction in new orders accelerated, with panelists noting lower demand from both domestic and foreign markets. Production slowed, employment contracted, and input prices fell for the sixth straight month, albeit at a lower pace.

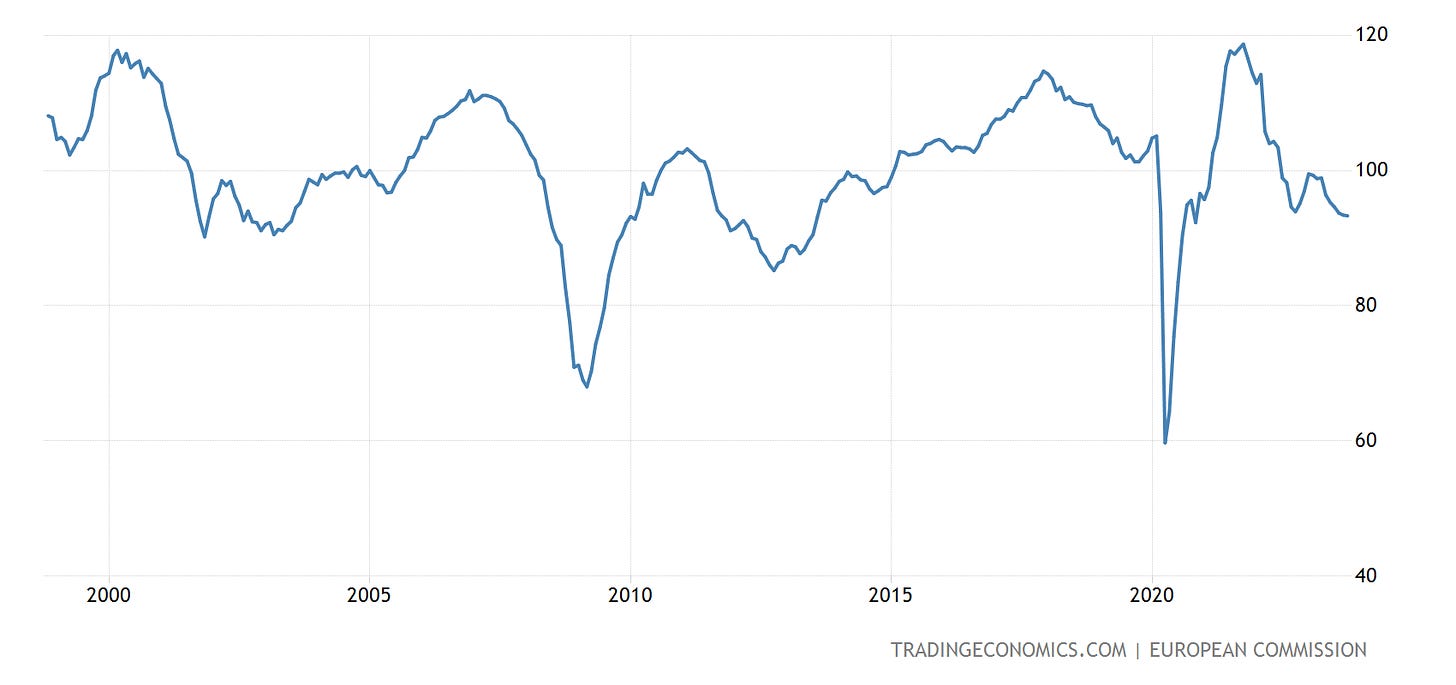

A preliminary estimate showed that the German economy contracted by 0.3% year-on-year in the third quarter of 2023, after being unchanged in the preceding three-month period.

Germany GDP has been on a steady decline since summer 2021, and the latest readings point towards Germany entering into recession in the near future.

Sources:

https://tradingeconomics.com

https://www.freightwaves.com/news/americans-are-getting-spendy-again-but-its-not-ending-jaw-dropping-trucking-bloodbath?oly_enc_id=0917F6545389D4E

Financial Markets

Week-on-week, the main stock market

indices rised abruptly, with the S&P500 gaining 5.9%, the NASDAQ 100 up 6.5%,

and the RUSSEL 2000 7.6% in the green. Gold is down by 0.7%, and silver gained 0.5%. The barrel of WTI is down 5% and is

now around 81$ per barrel.

Bitcoin rised 0.7% and stabilized around ~34700$.

The relative

strength of the US dollar fell 1.4%. US

bond yields fell considerably, now sitting at 4.57% for the 10-year and 4.77% for the 30-year.

The US bond yield curve remains inverted and is now peaking at 5.48% in 6

months from now.

Comment Section

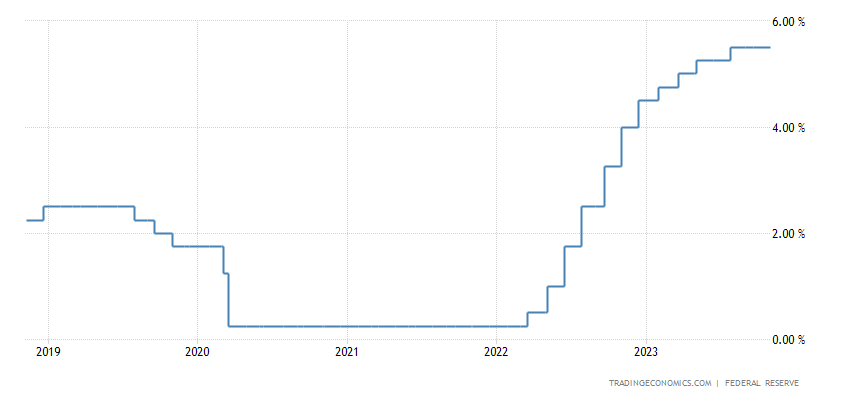

The beginning of November was marked by the FED decision of holding interest rates at 5.5%, which was interpreted by the market as the end of the hiking cycle. US 10-yier yields dropped way below the 5% mark and stock markets reacted very positively. In a few days we'll have confirmation of the breath of this stock market rally, but if we had to guess, we would say it's not going to be either very long or very exuberant. The mid-term trend is bearish. Take care, and subscribe for more economic news and comments.

Recommended Videos

Video: RUIN: Money, Ego and Deception at FTX

Channel: Bloomberg Originals

Video: Lynette Zang: US Treasury Bond Problems Signal System Collapse? Non G7 Gold Demand At All Time High?

Channel: WallStForMainSt

Video: The Price Cuts just got even BIGGER

Channel: Reventure Consulting

Comments

Post a Comment