Financial Markets (Weekly)

Week-on-week, the main stock market

indices were slightly up, with the S&P500 up 0.6%, the NASDAQ 100 up 0.2%,

and the RUSSEL 2000 up 1.0%.

Gold fell 0.5% and is holding the ~2320%/oz level. If gold breaks below the 2300$ level, it could fall until ~2150$/oz. Silver is unchanged relative to the previous week, and still seems to be in a downward trend (the next support should be around 28$).

The barrel of WTI rised 2.7% to ~80$ per barrel. It looks like WTI could continue in the range of 75-85 USD/bbl over the next weeks.

Bitcoin fell 3.9% and is around 64000$. It has been in the range of 60k-72k$ since March 2024 and if if falls below 60k, the sentiment might turn more bearish and risk averse.

The relative

strength of the US dollar (DXY) is slightly up (+0.3%), and has been stable in the range 104-106 since April 2024.

Financial

conditions (NFCI) loosened again relative to the previous week. Based

on the current trend, we predict that financial conditions could hit a

wall in the window of August-October 2024, which could be the start of a

bigger correction in the markets or coincide with a narrative change

(or even a recession).

M2 money supply (USM2) rised only slightly and is around 20.867T$.

US bond yields didn't change much (slight increase) and now sit at 4.74% for the 2-year and 4.26% for the 10-year.

Comment Section

New record highs were reached on the S&P, but the NASDAQ put up a

topping tail, that is, the new record high was rejected and the week

closed essentially unchanged. NVDA is probably going to pull back the

market a little bit during the next week. The Russel 2000 continues sideways.

The VIX (volatility index)

increased slightly but is still historically low,

indicating that investors are not seeking puts for protection, expiring in the next

~25-30 days. High yield bond spreads are still small, indicating low stress on the credit markets (good credit availability).

On the macro side, there are signs of the US economy slowing down, a sluggish China, and a stagnant Europe. The ECB started cutting rates, as did the Swiss National Bank. This year, the FED is also expected to start cutting rates. Note that historically, interest rate cuts coincide with the beginning of a recession (plus or minus a few months).

Good luck.

Recommended Videos

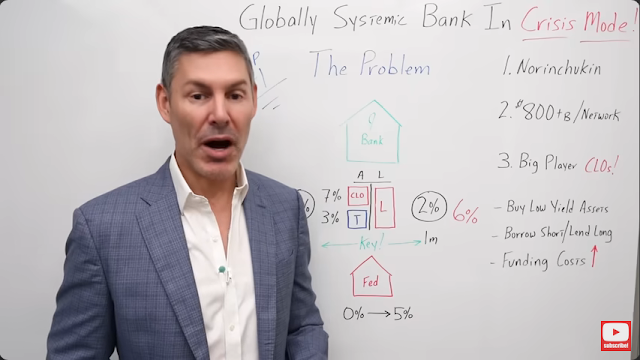

Video: This Globally Systemic Bank Just Went Into Crisis Mode (Derivatives)

Channel: George Gammon

Video: Retail apocalypse underway. Stores shutting down.

Channel: Reventure Consulting

Video: Trading & Investing: Nvidia Tops, Reversion Trade Opportunity, Global Worries, Bitcoin Danger Zone

Channel: Gareth Soloway

Comments

Post a Comment